Fraud services.

Reduce fraud and PCI scope, all at once.

Combine tokenization with fraud prevention to decrease your fraud rates, strengthen your fraud analysis, and increase your authorization rates—all without introducing PCI scope.

What can it do?

Reduce fraud rates

Leverage Kount’s digital fraud protection model to set risk thresholds, receive a risk score, and easily accept, block, or hold transactions.

Keep downstream systems out of scope

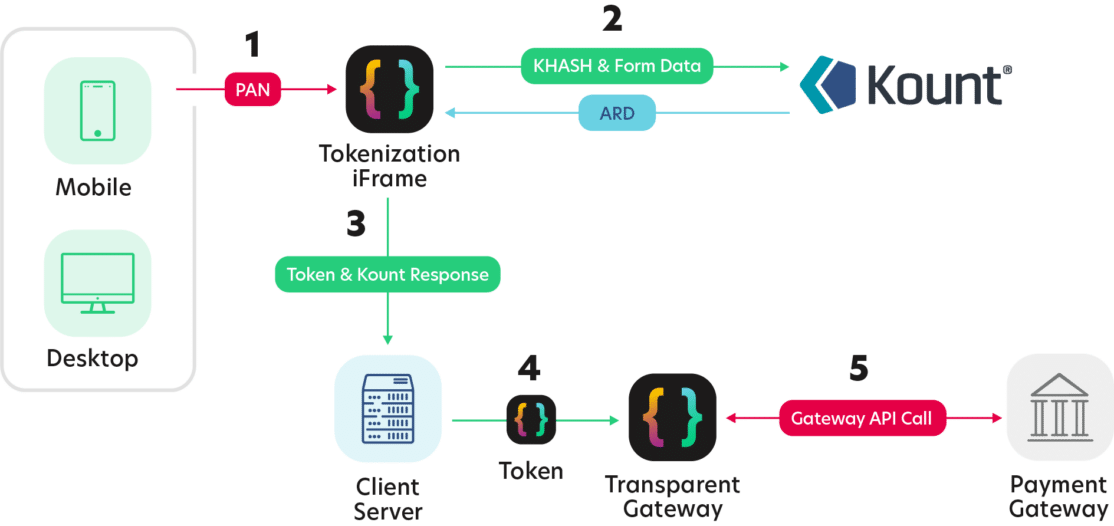

Use the TokenEx iFrame to capture sensitive payment information, then send that payment information to Kount to enhance your fraud analysis—all without incurring scope.

Two payments tools for the work of one

Reduce your development time with a single integration to unlock the power of Kount digital fraud protection and TokenEx universal tokens.

How does it work?

Accept payments via TokenEx

Send us your sensitive data

Accept sensitive payment information across channels without incurring PCI scope. Keep control of your payment data and route payments to any processor for increased authorization rates.

Receive a risk score from Kount

Use fraud services to reduce your fraud rates

Utilize Kount’s machine learning model to assess the riskiness of a transaction in milliseconds. Set custom rulesets specifically for your business. Automatically hold, accept, or block transactions based on the risk score—all without impacting the user experience.

Scope-free fraud prevention

Fraud prevention without the risks and burden

Let TokenEx send and store the necessary cardholder data so you can enjoy fraud prevention without the compliance burden and risks of storing credit card information.

Product Features

- Train the machine learning model with custom rulesets to reduce fraud automatically

- User portal to quickly review transactions for approval

- Transaction reporting for chargeback management

- Reduce operational burden with automated transaction approval

- Tokenized payment data to maximize data security while minimizing PCI scope

- Flexibility to route transactions to any payment processor

FAQ

Do you have any documentation about Fraud Services?

Please review our API Docs.

How do I get started with Fraud Services?

To get started, request a demo. Already a TokenEx customer? Reach out to your customer success manager to learn more.

Can I connect with any fraud provider?

At this point, we’re only able to connect with Kount Fraud Protection. However, this is subject to change so please check back.

What if I already use Kount?

If you’re already a Kount customer, contact us below to connect Kount with TokenEx to strengthen your fraud model with a KHASH.

Why should I connect fraud services with TokenEx?

Streamline your payment orchestration tools to reduce your operational burden. By combining tokenization with fraud protection, you’ll be able to increase your authorization rates, reduce your PCI scope, and reduce fraudulent users in your environment.

How can I get it?

Let’s talk about your business to see how we can help.