unify your payment data

Universal Tokens

Securely collect, store, and analyze payment data across all payment methods and processors. Reduce your PCI scope by up to 90%, increase authorization rates, and send payment data to multiple processors.

Why is it valuable?

Gain control of your payment data

Own your payment data and remove the need to manage payment information across multiple systems.

Minimize PCI Compliance Burden

Replace sensitive data with non-sensitive tokens to spend less time, money, and resources on PCI audits.

Flexibility to add or change processors

Seamlessly switch, add, or remove payment processors without needing to transfer your tokens.

Gain customer insights

With all your payment data in a single location, tracking customer purchases across channels and processors is easy.

How we solve the problem

Ownership, control, and flexibility

Owning your payment data gives you the flexibility to use multiple payment processors. This control allows you to route transactions to the ideal processor to improve your authorization rate. Universal Tokens also work across your in-person and online channels, giving you a unified view of customer behavior.

A robust, scalable cloud platform

Universal Tokens are built on a robust, dependable cloud platform that is scalable to handle large transaction volumes during peak demand periods. This platform has a high system uptime and availability, so you have stability in your business.

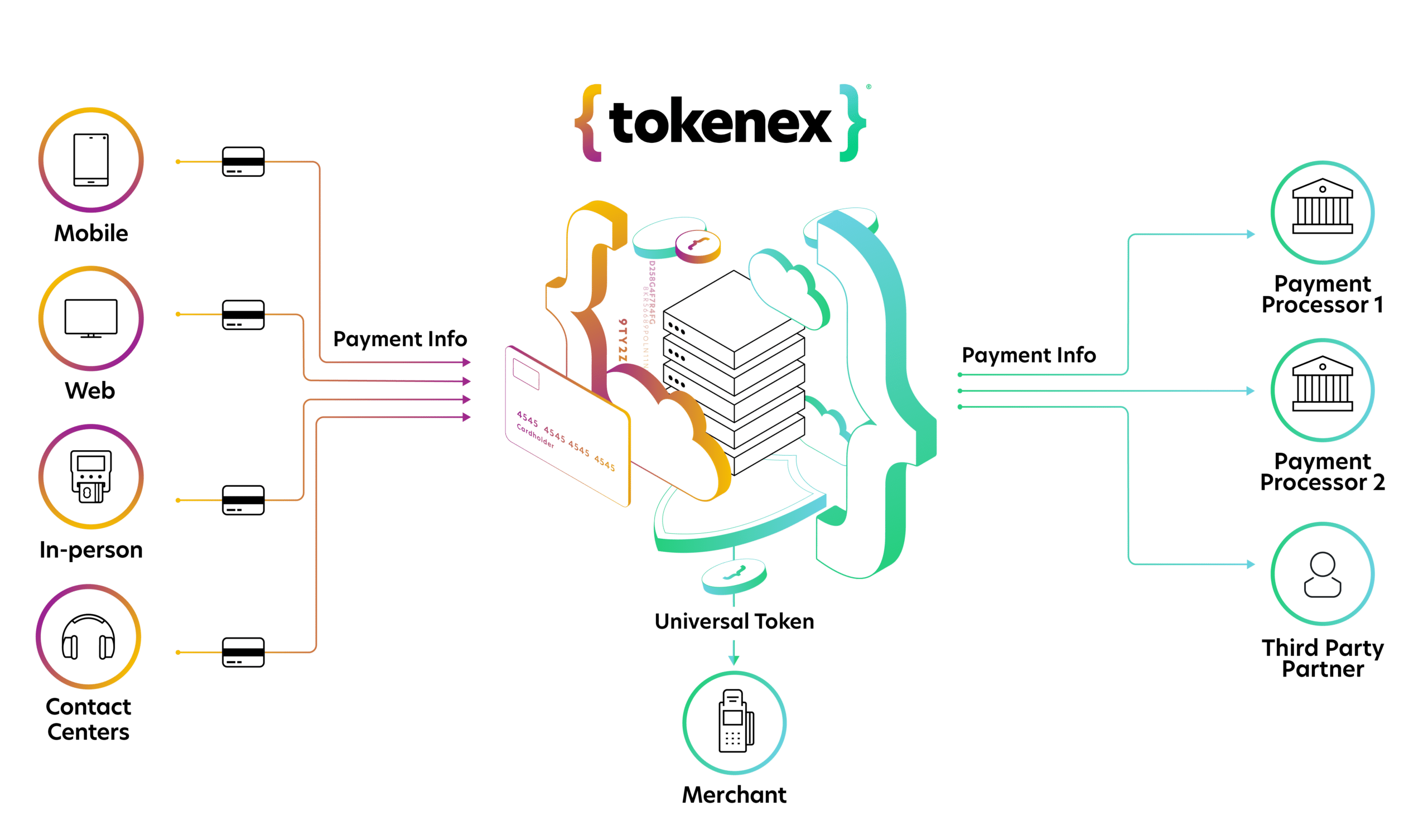

How it works

Accept payment information

Securely accept payments…everywhere

Accept payment information across different channels, all while reducing your PCI scope and gaining flexibility and control over your payments.

With TokenEx, you’ll have one payment token that spans your in-person and online channels and all your payment processors. This eliminates storing payment data in multiple systems, which reduces system complexity and improves customer data analysis.

You also minimize risk by keeping sensitive information from your company’s internal systems.

Acceptance Channels:

In-person: Point-to-Point Encryption (P2PE)

Web: Hosted iFrame, Browser-Based Encryption

Mobile App: Mobile API

File: Batch

API: Token Services API

Phone: Call Centers

securely exchange payment information

Processor compatibility and flexibility

Send sensitive payment information to any payment processor or third-party partner, with the flexibility to easily add or change processors as needed. Utilizing multiple payment processors allows you to optimize payment authorizations by sending transactions to the ideal processor.

Integration Points:

Connect to any payment gateway or API: Transparent Gateway

Pre-built connections to popular gateways: Payment Services

FAQ

What are Universal Tokens?

Universal Tokens are non-sensitive payment tokens that can be stored in place of sensitive credit card information. Whenever payment information is needed, the token is sent to TokenEx. TokenEx will swap out the token with the actual credit card information and send it to a payment processor. Tokens from TokenEx are ‘universal’ because they work across all processors and payment channels. To learn more about tokenization, visit this page: What is Tokenization?

What is PCI DSS 4.0? Do Universal Tokens make it easier to comply

with the PCI DSS standards?

PCI DSS 4.0 is the latest version of the Payment Card Industry Data Security Standards (PCI DSS). These standards specify the process and procedures companies must take to protect credit card information that passes through its systems.

Utilizing TokenEx to accept payment information makes it easier to comply with the PCI DSS requirements. By utilizing Universal Tokens to accept payment information, you keep it out of your company’s internal systems. Instead, you are only storing a non-sensitive token. Since credit card information isn’t stored in your systems, you can eliminate up to 90% of PCI DSS requirements. Additionally, this protects your system in case of a breach since tokens can’t be traced back to the original payment information.

Learn all the basics about PCI DSS and how to become compliant in this blog: PCI DSS 4.0: How to become PCI Compliant.

Where can I find technical document documentation on Universal Tokens?

You can find technical documentation in our library of API Docs.

How should I choose a tokenization solution?

Read through our solutions guide to learn more about what to look for in a tokenization solution.

Learn more about TokenEx and our thought leaders.

I can tokenize for free with my payment processor(s). Why should I

use TokenEx?

By working with TokenEx, you can access universal tokens that can be used across any payment processor. This is beneficial because it allows you to expand your business into other regions, increases your authorization rates, and gives you control over your payment data. Typically, by using a payment processor’s tokens, you’re locked into that processor and can’t easily add, change, or remove payment processors.

Does TokenEx have a PCI-validated point-to-point encryption (P2PE) for accepting card present payments?

Yes, the TokenEx P2PE solution for in-person (card present) payments is PCI-validated. This validation significantly reduces your PCI scope, reducing the number of PCI requirements you need to meet by up to 90% and lowering the time and cost of PCI audits.

Why is using TokenEx better than building my own system for

handling payment data?

TokenEx provides our clients with a single token that can be used across payment service providers, allowing our clients to add or switch gateways/acquirers without having to retokenize or manage yet another set of tokens. In addition, TokenEx has a comprehensive suite of tokenization solutions, exceeding those offered by most payment gateways. Our tokenization solutions also include the provisioning and life-cycle management of network tokens, which can be used with any gateway/acquirer that supports them.

You can remove the burden of managing multiple sets of tokens specific to each acquirer or gateway that issued them. By using TokenEx, you get access to agnostic tokens, which means you can use your tokens across any gateway and acquirer – allowing clients to increase their acceptance rates and making it easier for clients to process payments by using agnostic network tokens.

Do Universal Tokens support my payment processor(s)?

Yes, TokenEx can connect to any payment processor or 3rd party API endpoint.

What are the different ways I can accept payment data with

Universal Tokens?

Universal Tokens offer a variety of ways to accept payment data in a secure and PCI-compliant manner. The most common methods to accept are in-person (P2PE), web (iFrame), and mobile app (Mobile API). Additionally, we can accept data via API (Proxy Tokenization), File (Batch), or Phone (Call Center Solutions).

With Universal Tokens, you can receive payment information from any of these channels and send it to any payment processor you use. This eliminates the burden of storing payment information in multiple systems and makes it easier to identify customer insights across your payment channels.

How can I reduce my organization’s dependency on a single payment processor?

Becoming too reliant on a single payment processor creates the risk of “processor lock-in”. TokenEx prevents this lock-in by giving you ownership of payment data and working with all payment processors. This gives you the flexibility and freedom to add, change, or remove payment processors to meet the needs of your business. Once you can utilize multiple payment processors, you can work on improving your authorization rate, quickly entering new markets, and lowering processing costs.

How Universal Tokens has helped our clients

How can I get it?

Let’s talk about your business to see how we can help.