point-to-point encryption (p2pe)

Simple PCI compliance for in-person payments

TokenEx PCI-validated Point-To-Point Encryption (P2PE) drastically reduces PCI scope for Card Present payments and unifies payment data across all channels and processors.

Why is it valuable?

Achieve PCI compliance

Reduce PCI scope by up to 90% and keep sensitive data out of your internal systems with a PCI-validated P2PE solution.

Gain ownership of payment data

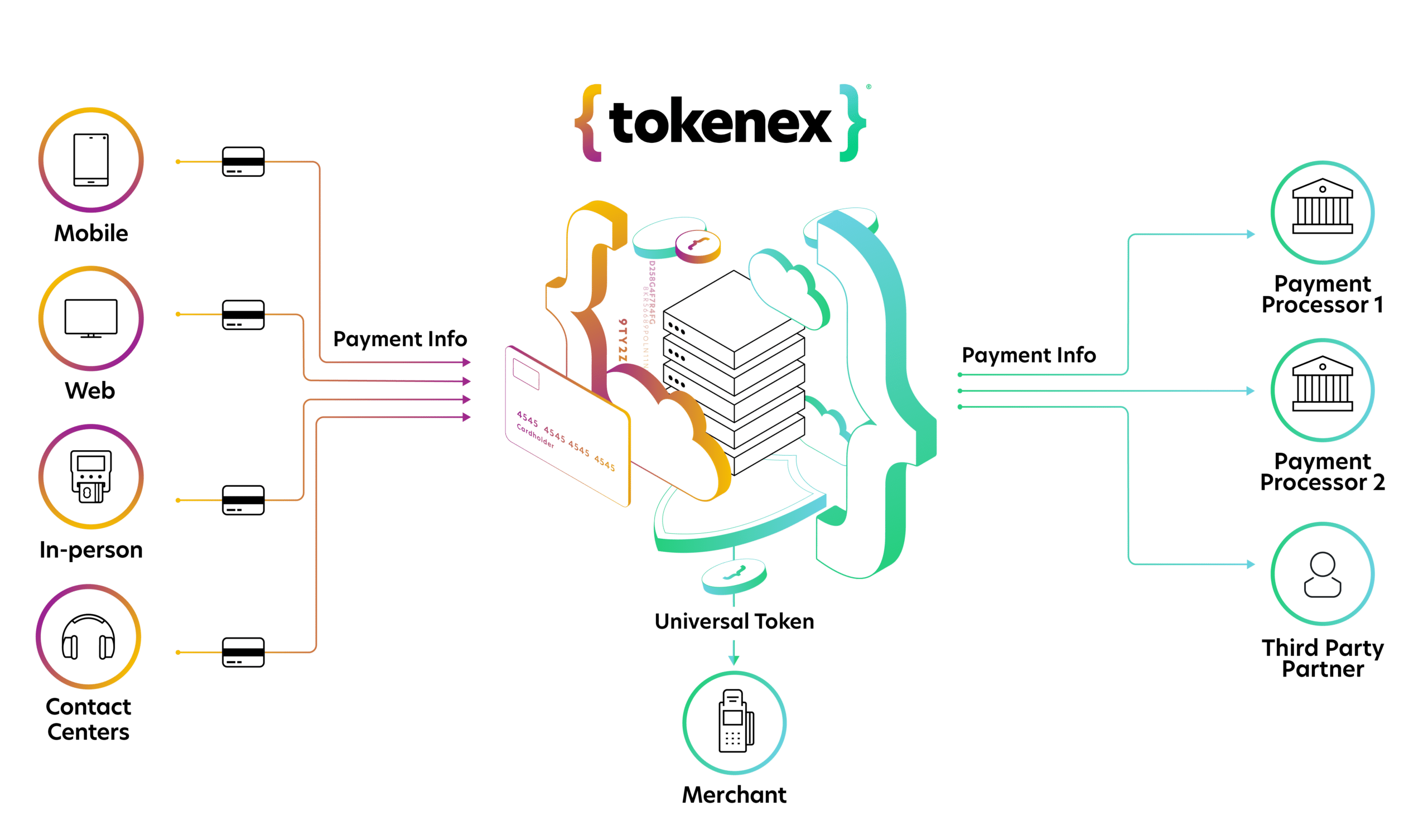

Utilize a universal token to unify payment information, analyze customer data, and support loyalty programs across your in-person and online channels.

Use any payment device*

Utilize new devices or maintain the functionality of existing terminals with the ability to easily upgrade later.

Gain processor flexibility

Reduce “processor lock-in” from existing payment terminals and gain the flexibility to add new processors, control your payment flow, and improve authorization rates.

*Must be on the list of PCI-approved PIN Transaction Security (PTS) devices.

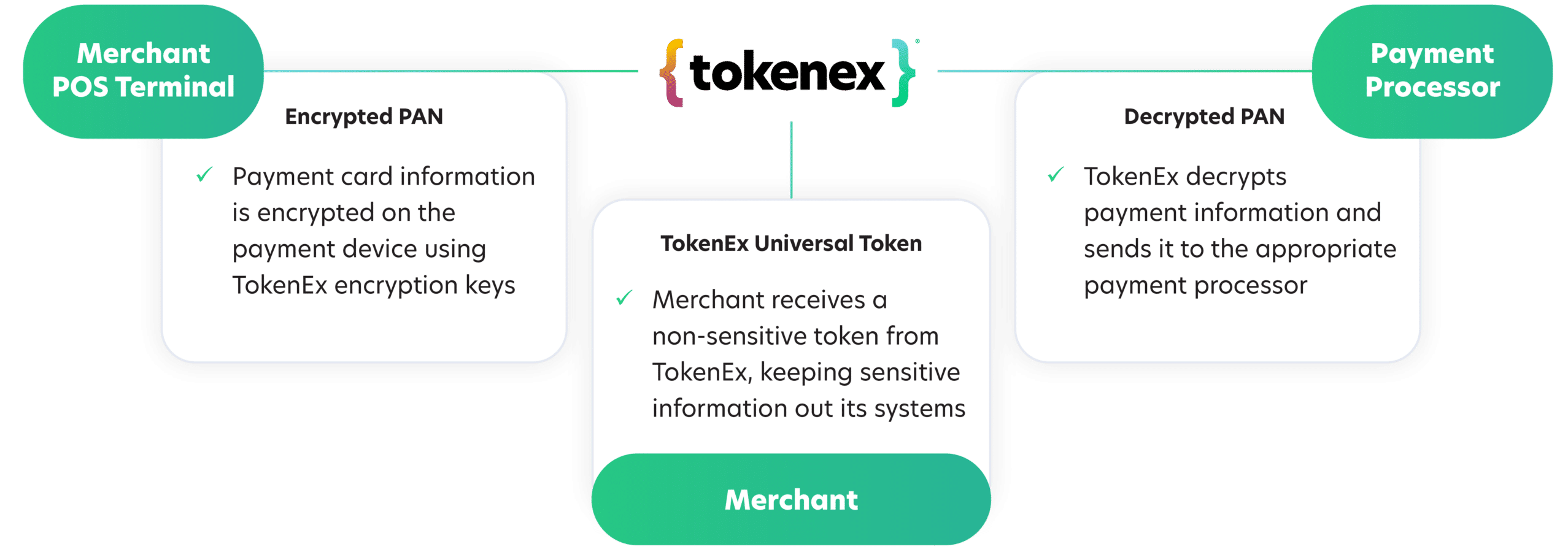

How it works

Unified Payment Data Across

Channels and Processors

FAQ

What is P2PE?

Point-to-point encryption (P2PE) is the Payment Card Industry (PCI) standard for using cryptography to securely collect and exchange payment information from an in-person device or terminal. By using P2PE, payment information is unreadable until it reaches a secure decryption environment. An in-person payment solution isn’t considered ‘P2PE’ unless it has been reviewed and validated by the PCI council. Solutions that aren’t PCI-validated certified are not considered P2PE and will incur additional PCI scope.

What does ‘PCI-validated P2PE’ mean?

A ‘PCI-validated’ P2PE solution, like the one offered by TokenEx, has passed a rigorous evaluation from the PCI SSC to confirm that it meets the P2PE standard. This is important in not only ensuring appropriate security for in-person payments, but also reducing PCI scope related to in-person payments.

What kind of encryption technology is used for the TokenEx P2PE solution?

TokenEx uses AES encryption to provide modern, strong cryptography for payment transactions. However, our solution also supports TDEA (“Triple DEA”) encryption which is common for existing hardware.

I currently use different processors for in-person and online payments. Can the TokenEx P2PE solution work with multiple processors?

Yes, when you accept credit card information using the P2PE solution, you will receive a Universal Token that be used across your different payment processors. This eliminates the burden of storing payment information in multiple systems and makes it easier to unify customer insights across your in-person and online channels.

I am already using encryption in my payment terminals. Do I still need a “PCI-validated” solution?

Yes, you do. Encryption does help with securing payment data, but encryption alone does not reduce PCI scope. Utilizing a solution that isn’t PCI-validated means that your in-person payment flows will be under increased scrutiny during your PCI audit. This will require a big effort from your team to build, document, and audit processes to ensure that in-person payment data is handled appropriately.

Using a PCI-validated P2PE solution can remove your in-person payments from scope and reduce the number of PCI requirements you need to meet by up to 90%. This reduced scope translates to less time your team spends on preparing for audits and more time on other critical security initiatives.

How much does this cost?

Transactions using P2PE are priced per operation, similar to our other acceptance methods for Universal Tokens. A typical P2PE transaction will require two operations: one to decrypt the payment info and send it to a processor, and one to tokenize the data for future use. To learn more about our pricing, please visit: token.com/pricing.

What payment devices does TokenEx P2PE support?

The TokenEx P2PE solution can support any payment device or terminal that is on the list of PCI-approved PIN Transaction Security (PTS) devices. You can find a listing of PCI-approved PTS devices here.

Where can I find additional documentation about the TokenEx P2PE solution?

You can find technical documentation at docs.tokenex.com.

See P2PE in action

Let’s talk about your business to see how we can help.