Reduce FRAUD. MINIMIZE SCOPE.

Layered security for payments

Increase your authorization rates by combating card-not-present fraud layered with network tokenization. All without introducing PCI scope into your downstream systems.

Data protection + fraud prevention

Keep downstream systems out of PCI scope

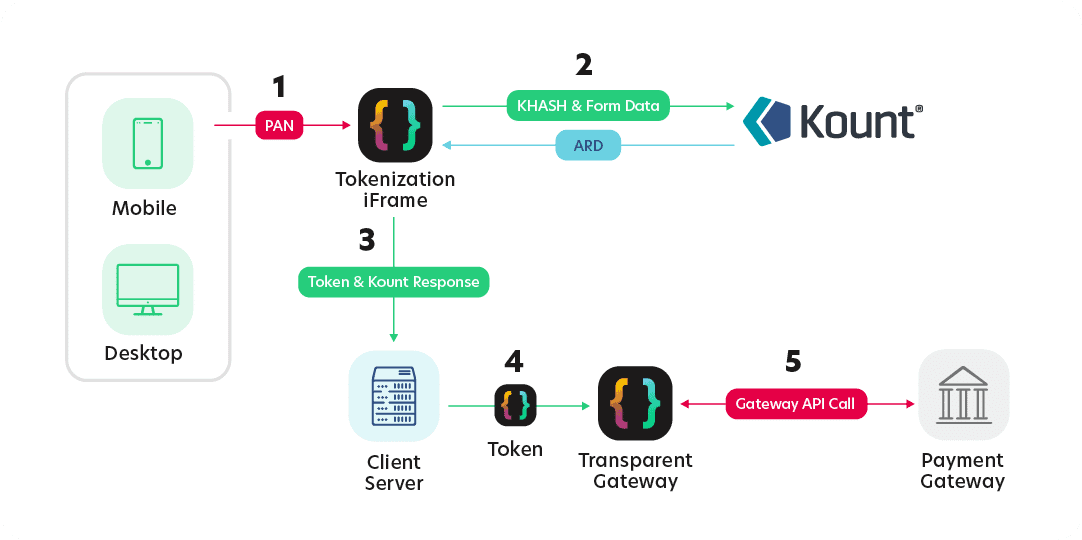

Use the TokenEx iFrame to capture sensitive payment information before it enters your environment.

Increase your authorization rates

Leverage Kount’s digital fraud protection services alongside TokenEx’s agnostic tokens to protect and grow your business.

Two payments tool for the work of one

Reduce your development time with a single integration to unlock the power of Kount and TokenEx.

Gain a competitive edge

“Incorporating tokenization from TokenEx and fraud prevention from Kount was one of the smartest decisions we made to differentiate our ecommerce services from our competitors. Using a layered approach to prevent data theft and payment fraud creates a secure foundation that keeps data safe from breaches and the cost of fraudulent purchases down.”

Nevin Shalit

CEO, The Araca Group

FAQ

What are the benefits of integrating Kount and TokenEx?

When using TokenEx and Kount together, you can feed sensitive payment information into the Kount fraud model without taking on PCI scope. And in a single API call, you can run a fraud check and generate a token to pass on to your payment gateway.

I’m already using Kount. How do I get started with TokenEx?

You can get started by filling out this form, and someone from our team will reach out to you.

I’m already using TokenEx. How do I get started with Kount?

Reach out to your TokenEx account manager to get started today!

I’ve already purchased Kount and TokenEx, and now I want to integrate. How do I do that?

- Set fraudServices.useKount to true and provide fraudServices.kount.merchantId in iFrame configuration.

- Load the iFrame. Kount data collection takes place in the background.

- Set order details via setFraudServicesRequestDetails method.

- Call Tokenize if step 4 is successful.

- If setFraudServicesRequestDetails fails, verify the payload and retry setting the request and tokenizing.

How is tokenization different from other providers?

Unlike other providers, TokenEx does not hold your data hostage. Instead, we give you more ways to use it safely so you can add value to your data and to your business.

What are some of the outcomes TokenEx has generated for its Kount clients?

Bolder Road, an ecommerce company, integrated with TokenEx and Kount to capture card data directly from its checkout pages so it can be sent to Kount for a fraud evaluation without introducing PCI scope. This process is seamless for the end consumer, creating a secure, frictionless transaction.

“Using a layered approach to prevent data theft and payment fraud creates a secure foundation that keeps data safe from breaches and the cost of fraudulent purchases down,” Bolder Road CEO Nevin Shalit said. “Incorporating tokenization from TokenEx and fraud prevention from Kount was one of the smartest decisions we made to differentiate our ecommerce services from our competitors.”

Contact us

The combination of layered payment security and network tokenization enables our customers to positively impact revenue, reduce PCI scope, and reduce development time.

Want to learn more? Contact us today!

Submit a message

and we will get back to you

How to Choose

a Tokenization Solution

Make sure you’re asking the right questions by reading this resource.